Navigating Economic Turbulence: Why Private Equity Shines Bright

The global economic slowdown, problems in the banking sector and the possibility of recession in some advanced economies have led some analysts to argue that private markets could encounter challenges. However, history suggests otherwise. Some of the best-performing private-equity returns were generated in the wake of the dot-com crash and the global financial crisis. Moreover, there are reasons to believe that private equity will perform even better than in the past should a recession occur this year.

The outlook for the global economy remains unclear, but many analysts believe recession remains a distinct possibility in the advanced economies of the West. The International Monetary Fund, for example, argues that while it expects major economies such as the U.S. and Germany to see positive growth this year and next, “risks to the outlook are heavily skewed to the downside, with heightened chances of a hard landing.”[1]

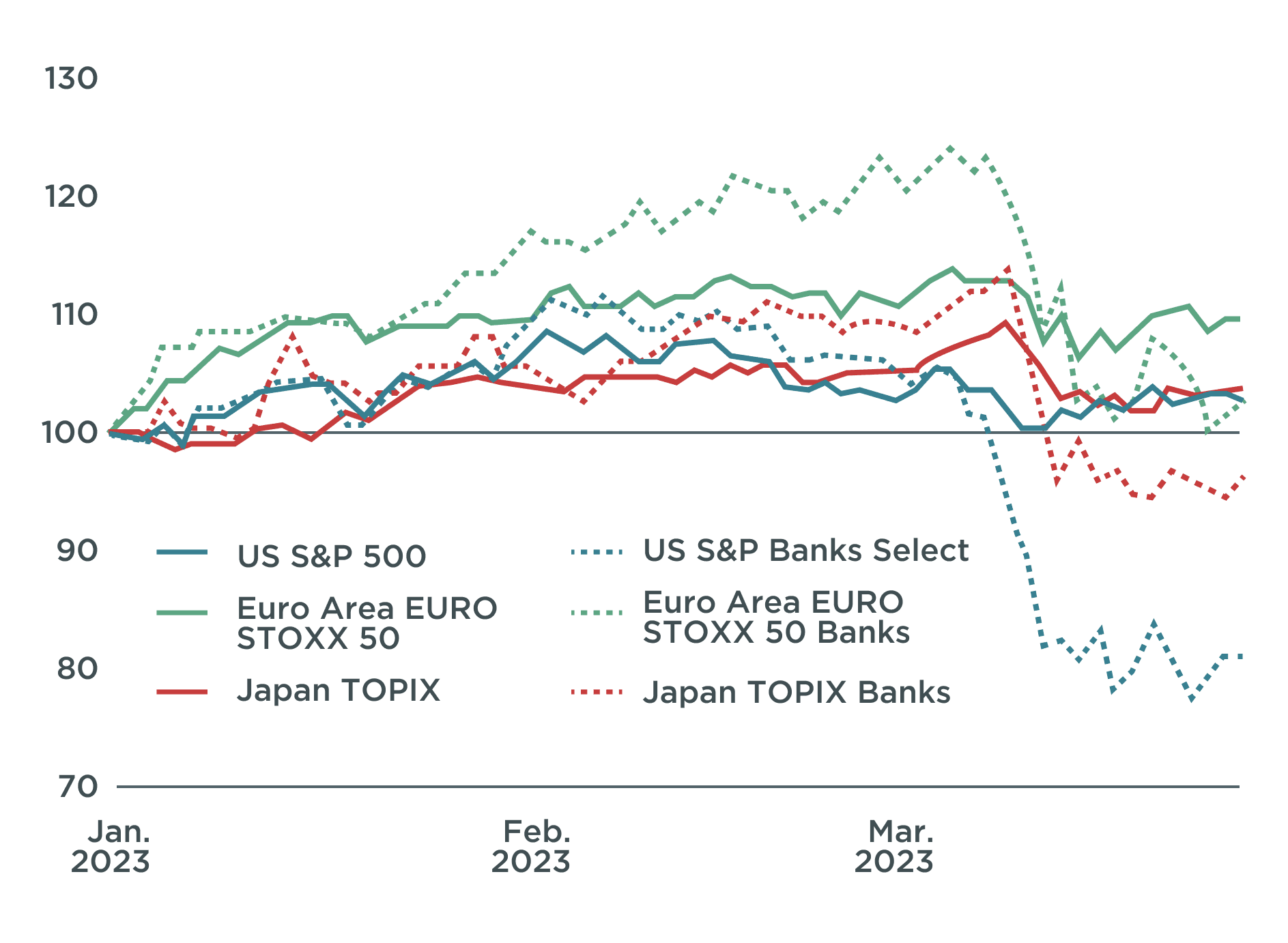

The sharp sell-off across global equities that took place in March, sparked by news of problems in the U.S. banking sector, highlights what can happen in public markets when the economic outlook deteriorates.

However, the evidence suggests that private equity is likely to hold up well in the face of deteriorating economic news. Periods of recession have, in fact, provided some of the strongest vintages in private equity; the dot-com crash of 2000–2001, for example, produced the best-performing private-equity market in more than 20 years. The 2008–2009 global financial crisis also delivered above-average returns for private-equity investors.[2]

There are reasons to believe that private equity should prove even more resilient during any future recession. These include:

More capital: the industry has grown significantly since the global financial crisis. By December 2022, the global private-equity industry had a record level of cash reserves available for buyouts and other investments, with an estimated $1.96 trillion in dry powder, according to Preqin Pro.[3] The EY consultants say this means that private-equity firms have access to more capital to double down on promising companies that are experiencing temporary distress from macro forces.[4]

Greater diversification: over the past decade and more, private-equity firms have diversified across a wide array of strategies, including growth capital, real estate, infrastructure, sector-specific funds and, in particular, private credit, leaving them less exposed to a downturn in one particular sector. Limited partners are also becoming more sophisticated in searching for growth, sector focus and diversification potential across the whole of the private-equity spectrum.

Improved operational capabilities: private equity has expanded its capabilities through the deployment of new technologies, such as artificial-intelligence algorithms that can quickly analyse vast quantities of data, and by adding operating partners. EY concludes that firms are better placed “than ever before to respond to the challenges of economic dislocation at their portfolio companies”.[5] Petiole Asset Management AG, for example, has grown its expertise in private equity through many cycles of investing in this asset class. Petiole maintains a disciplined approach to deal selection, risk management and portfolio construction.

In conclusion, there is plenty of evidence to suggest that a recession can be viewed as an opportunity for private equity to acquire assets at attractive prices, rather than something to fear. Petiole, for example, has accelerated its investment activities this year and recently completed four private-equity transactions in the technology and business-services sectors. However, there is a sense that deals in the industry are structured differently, with private-equity sponsors increasing their equity allocation.

Key takeaways

History suggests that, in sharp contrast to public markets, private equity tends to hold up well during periods of economic difficulty.

There are various reasons to believe that private equity will perform even better than in the past should a recession occur this year.

Recessions can provide an opportunity to acquire assets at attractive prices.

[1] IMF

[2] Moonfare

[3] SP Global

[4] EY

[5] EY

Disclaimer

The statements and data in this publication have been compiled by Petiole Asset Management AG to the best of its knowledge for informational and marketing purposes only. This publication constitutes neither a solicitation nor an offer or recommendation to buy or sell any investment instruments or to engage in any other transactions. It also does not constitute advice on legal, tax or other matters. The information contained in this publication should not be considered as a personal recommendation and does not consider the investment objectives or strategies or the financial situation or needs of any particular person. It is based on numerous assumptions. Different assumptions may lead to materially different results. All information and opinions contained in this publication have been obtained from sources believed to be reliable and credible. Petiole Asset Management AG and its employees disclaim any liability for incorrect or incomplete information as well as losses or lost profits that may arise from the use of information and the consideration of opinions.

A performance or positive return on an investment is no guarantee for performances and a positive return in the future. Likewise, exchange rate fluctuations may have a negative impact on the performance, value or return of financial instruments. All information and opinions as well as stated forecasts, assessments and market prices are current only at the time of preparation of this publication and may change at any time without notice.

Duplication or reproduction of this publication, in whole or in part, is not permitted without the prior written consent of Petiole Asset Management AG is not permitted. Unless otherwise agreed in writing, any distribution and transmission of this publication material to third parties is prohibited. Petiole Asset Management AG accepts no liability for claims or actions by third parties arising from the use or distribution of this publication. The distribution of this publication may only take place within the framework of the legislation applicable to it. It is not intended for individuals abroad who are not permitted access to such publications due to the legal system of their country of domicile.

Let’s build your bespoke solution

We can create tailor-fit portfolios that suit various investment strategies and risk profiles. Our private market specialists would be delighted to explore with you your investment needs.