The alternative investment industry has seen greater allocations from limited partners due to its historical outperformance against public listed equities. Even in recessionary periods, private equity returns did not fluctuate and decreased as much as public ones on a long-term investment horizon.

Historical Trend

The year 2018 marked the first time more capital was raised through private markets than by public markets. The private equity industry has seen a heightened number of investors coming into this space, with institutional investors as the majority of limited partners to deploy capital. However, allocations are rising among high-net-worth individuals with wealth managers reporting target allocations of 8%. Why?

Record data shows that private equity's outperformance increases during distressed periods, which is a logical outcome given the long-term nature of the asset class. Private equity has generated strong returns at times when growth is scarce.

Its outperformance over public markets is well-documented, even against major indices, such as the S&P 500, generating 597 basis points over selected long-term periods.

At the onset of the Covid-19 crisis, many investors have asked themselves how private equity will perform during recessions. An economic downturn represents an opportunity for general partners to buy low and sell high. In addition, private equity firms can deploy capital at more attractive terms - facing fewer regulations and implementing bold, more calculated actions than being distracted by actions to achieve short-term success as public firms do. In a survey from Preqin taken in June 2019, 87% of institutional investors claimed to either increase or keep their allocations. In April 2020, when Covid-19 hit with all its restrictions, the percentage of private equity allocations has risen to 91%.

At the onset of the Covid-19 crisis, many investors have asked themselves how private equity will perform during recessions. An economic downturn represents an opportunity for general partners to buy low and sell high. In addition, private equity firms can deploy capital at more attractive terms - facing fewer regulations and implementing bold, more calculated actions than being distracted by actions to achieve short-term success as public firms do. In a survey from Preqin taken in June 2019, 87% of institutional investors claimed to either increase or keep their allocations. In April 2020, when Covid-19 hit with all its restrictions, the percentage of private equity allocations has risen to 91%.

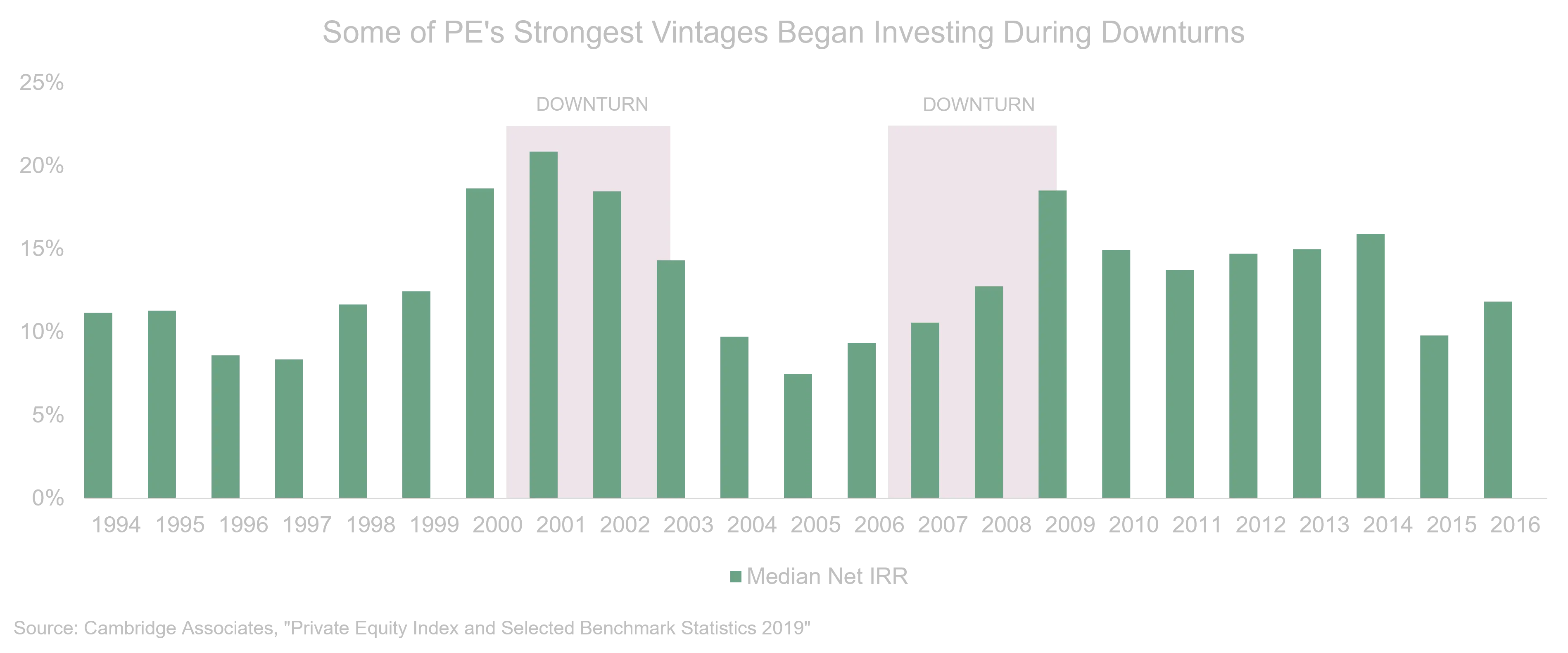

Cliffwater’s analysis of U.S. state pension plans presents that during a 16-year period, private equity has outperformed public equities by 440 basis points annually on average across the pension plans. When the economy was in expansion, private equity outperformed on average by 290 basis points. Interestingly, however, this increased to an average of 660 basis points during recessions. The median net internal return of U.S. buyout funds across vintages was observed to dramatically rise wth their strongest performance during economic downturns, including the dot-com and global financial crisis (GFC). This suggests that private equity firms’ long-term nature offers advantages and more resilience during difficult times.

The median net internal return of U.S. buyout funds across vintages was observed to dramatically rise wth their strongest performance during economic downturns, including the dot-com and global financial crisis (GFC). This suggests that private equity firms’ long-term nature offers advantages and more resilience during difficult times.

Several reasons could be attributed to this finding:

Private equity managers often have an information advantage over public market investors, as they can use dry powder to alleviate a company’s financial issues and help them to renegotiate loan and debt obligations. It has been noticed that private equity-backed companies actually increased CapEx investments relative to their peers since they had better access to capital, both from funds and relationships with banks and lenders, which provided additional flexibility during economic downturns.

Private market investors can adopt a buy-and-build strategy when multiples are low during recession periods. This broadly offsets higher debt funding costs and consolidates the sector. Public companies tend to avoid investing activities during an economic plunge, which opens up opportunities for private companies.

Private equity firms are often sector specialists that can help companies grow. They are well-equipped to anticipate challenges ahead and plan going-forward strategies.

When studying different vintages and the magnitude of pricing swings in total-value-paid-in (TVPI), the more mature vintage funds were less affected than the younger ones. During the GFC, 8- to 9-year old funds barely experienced any decline in pooled TVPI whereas vintage funds of three to four years old nearly declined by 20%.

According to PitchBook, however, crisis-era vintage funds offer the best time to invest in buyout funds as they were able to invest in lower prices at a higher internal rate of returns (IRRs). Rather than holding or selling exposure, investors should allocate more to the space. When compared to public market indices, the S&P 500 for example fell by more than 50% during the GFC.

Covid vs Previous Crises

Covid vs Previous Crises

Apart from the first three months of 2020 when almost no transactions were done, the pandemic did not slow down the industry’s momentum. On the contrary, activities were significantly sped up due to low-interest rates, a high amount of dry powder, and a robust fundraising environment: private equity dealmaking in fact reached historic heights in 2021.

Although interest rates, potential tax reforms, and supply chain issues are increasing and intensified due to the current Ukraine-Russia conflict, the fundamentals remain in place for a strong 2022.

In a recent Bain study, 89% of executives from strategic buyers anticipate that their own deal activity will either stay the same or increase in 2022. This could be primarily because M&A is part of their business growth drivers, which is unlikely to change in due time. With this in mind, it can be assumed that 2022 would also provide many deals and investment opportunities, where the biggest and most experienced funds are noticeably raising the most money and doing larger deals.

On average, deal sizes in 2021 were more than USD 1 billion for the first time ever, which decreased the total amount of transactions that still lagged the pre-Covid-19 figures in 2019.

Limited partners were also looking for general partners who are more specialized in a specific industry rather than having a generalist investment approach. An example of this specialization includes technology-focused funds, such as fintech or health-tech, which have become the most dominant theme in the buyout world. In addition, other classes such as growth equity, infrastructure, and secondaries have seen an increased allocation percentage.

Petiole Asset Management grew its expertise in private equity through many cycles of investing in this asset class. We maintain a disciplined approach in deal selection, risk management and portfolio construction. Contact our team to know our private equity investment solutions.

Key Takeaways

Private equity investing proves beneficial in recessionary periods and has outperformed public markets due to its long-term investment horizon, information advantage, and ability to adapt to difficult situations.

The more mature funds are, the higher the probability of them overcoming economic downturns. These include funds that have their vintage year in recessionary years and could make use of the economic instability.

Limited partners are becoming more sophisticated in searching for growth, sector focus, and diversification potentials across the whole private equity spectrum. Therefore, general partner selection is a key criterion for limited partners, who increasingly favor niche or specialized industry focus.

References

The Agony and the Ecstasy, Eye on the Market Special Edition, J.P. Morgan, March 2021

Global Private Equity Report 2022, Bain & Company

Global M&A Report 2022, Bain & Company

Private Equity: 2021 Year in Review and 2022 Outlook, Steven A. Cohen, Karessa L. Cain, and Alon B. Harish, Wachtell, Lipton, Rosen & Katz, Harvard Law School Forum on Corporate Governance, February 9, 2022

Private Equity Offers Resilience in a Downturn, Investments & Wealth Monitor, Reprinted Article July/August 2020

Private Equity Performance in Times of Crisis, Crystal Capital Partners, August 10, 2020

Interested in learning more?